Improving the financial literacy in our area is one of the key ways that Carolina Trust tries to live out the credit union philosophy, "people helping people." To truly help our community, we have to go beyond providing them with financial services; we have to teach them healthy financial practices and help them implement them into their lives. Like learning anything, the earlier you start, the better off you'll be, which is why we put such a significant emphasis on financial literacy resources for our youth.

April is CUNA Youth Month, and Carolina Trust is celebrating in a lot of different ways. We're sharing financial content geared towards youth all month long, including activities, story time, and even a giveaway contest. You can visit our website for more information, and be sure to check back each week for new content.

If you're looking for a great way to start the conversation about finances with your child, bringing them into the credit union and opening a Goal Club account is a great place to start. Check out the BALANCE blog post below, "Is it time to open a checking or savings account for your children," for more information about the benefits of introducing your child to the world of personal finance at an early age.

Is It Time to Open a Checking or Savings Account for Your Children?

Topics: Personal Finance

7 Quick Tips About How to Make and Follow a Monthly Budget

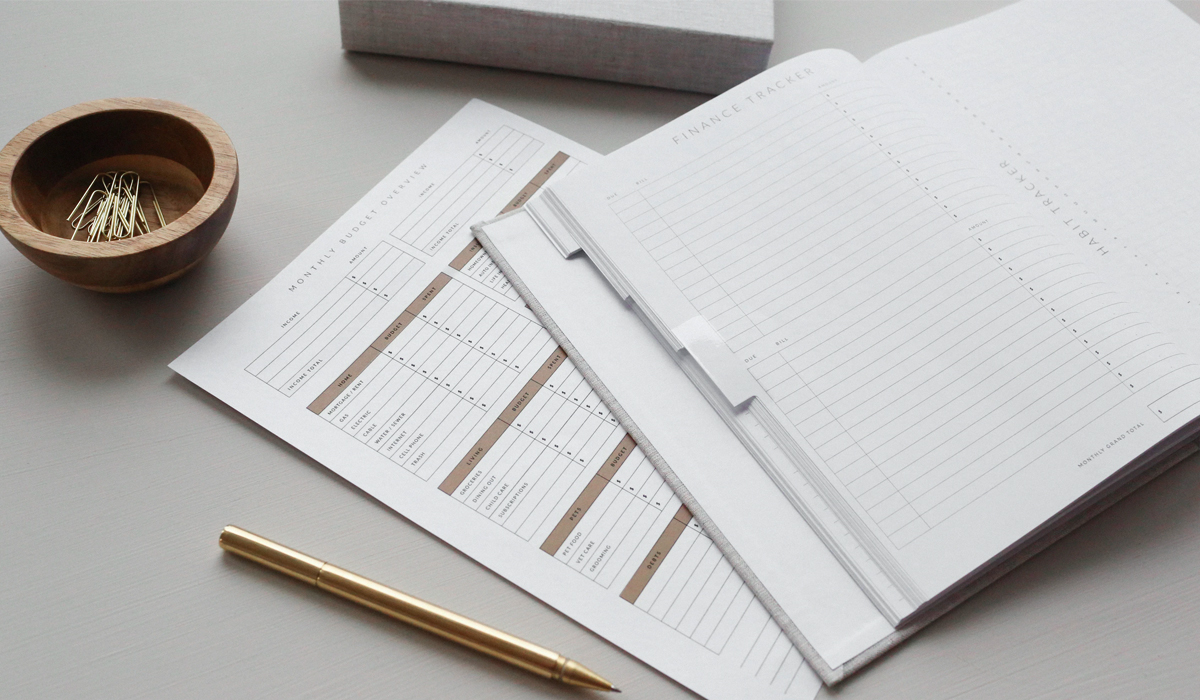

Knowing how to make a monthly budget is the important first step to financial freedom. That means retiring comfortably, spending time with your family, and traveling like you always wanted. Monthly budgets, however, aren’t something you can set and forget about. In order to make one work for you and your family, you must always review and tweak it. To help, here are seven tips for improving your monthly budget for your family:

Topics: Personal Finance, Credit Cards, Home, Life & School

How to Create a Budget in 5 Steps

Budgets are a valuable money management tool. Even if you’re happy with your financial health, budgets can keep you from slipping into bad habits. They can even help you save a lot of money. If you’re struggling to make ends meet, budgeting is an excellent way to get control of your spending.

If the word budget makes you think of never-ending columns and rows, don’t worry. There are budgeting methods that make it easier to manage your finances once a budget template is in place. There are even budgeting apps for your smartphone that can keep you on track.

Topics: Personal Finance, Home, Life & School

If You Need a Budget Follow These 5 Easy Tips to Get Started

According to the American Psychological Association's survey, which measures causes of stress, money consistently lands near the top with 61% of Americans reporting money-related anxiety. The biggest factor in this stress is overspending according to CNBC Personal Finance. We worry when total expenses (amount spent monthly) exceed total income (amount made monthly), causing mounting debt.

Create a monthly budget to ensure you do not spend more than you make in a month, forcing you to take on additional debt.

Topics: Personal Finance, Credit Cards, Home, Life & School

12 Ways To Save A Lot Of Money By Changing Daily, Weekly & Monthly Habits

The basic idea behind putting in long work-hours is that our quality of life will improve. Maybe you pull some overtime or go above and beyond to earn a raise or promotion. Regardless of how you go about increasing your salary, there’s an expectation that bank accounts will swell, and life will get a tad easier. One of the things that hold many of us back from saving a lot of money though is controlling our spending.

Topics: Personal Finance, Credit Cards, Home, Life & School

7 Pitfalls to Avoid When Looking for the Best Mortgage Lenders

If you are thinking about buying a new home, then this is an exciting time; however, buying a home is also a big decision. For this reason, you need to make sure that you take the time to get this decision right. That also means working with the right mortgage lender. Unfortunately, there are a lot of common mistakes that homebuyers may make when looking for a lender. Understand these common pitfalls so you can make sure to avoid them.

Topics: Personal Finance, Real Estate & Home Buying, Home Loans

Need to Refinance? Find the Best Mortgage Lenders: 10 Tips and Tricks

If you are thinking about refinancing your mortgage to a lower rate, then you are probably looking forward to saving money on your monthly payments. You can also go through the refinancing process to tap into the equity in your home to finance home improvements while also consolidating your other debts. At the same time, this is a big decision and you need to work with the best mortgage lenders to get a new home loan that is favorable to your financial situation. When it comes to refinancing your first mortgage, there are a few tips to follow.

Topics: Personal Finance, Real Estate & Home Buying, Home Loans

The economic impact of COVID-19 on our country has left many individuals facing job loss or furlough. Even those who have remained employed are facing concerns about paying bills and affording daily necessities due to cutbacks or reduced hours. If you've lost your job, been furloughed, or had your hours cut as a result of COVID-19, you may qualify for unemployment.

Topics: Personal Finance, Credit Building

The Truth About Debt Consolidation

Life happens, and along with it often comes debt…and you know what? That’s ok! Whether we have debt in the form of student loans, medical bills, an emergency of some sort that had to be financed, or too much spent on credit cards - we have all had our share of debt to repay.

Topics: Personal Finance, Debt Consolidation, Credit Building

How to Get Out of Debt Fast - Five Proven Tips

5 Tips to Relieve Your Debt and Stress

The average debt load for Americans, including mortgages and car loans, is $132,529. Of that, over $16,000 is tied up in credit cards. All of this debt contributes to a high level of stress for many families.

Topics: Personal Finance, Debt Consolidation, Credit Building