The phrase “passive income” is often thrown around by people wanting to make money by teaching you ways to earn it. Because the concept is so intriguing, there are a lot of misuses and misrepresentations of the term. After all, who doesn’t want to learn how to make thousands of dollars a month without doing anything to earn it?

4 Tips to Acclimate Your Child to a New School Year from Horry County Schools' Teacher of the Year

Preparing your child for a new school year can be difficult. Not only are there new school clothes and supplies that you have to stock up on, but meeting a new teacher and settling into a new environment can be both mentally and emotionally taxing and may require some help from you.

Topics: Home, Life & School

It’s a tough reality of living in a computer-driven world: scams will always find their way into popular technologies. Digital payment apps are no exception. With their use becoming increasingly a part of our everyday life, knowing the steps for safeguarding your information and maintaining control of your money is essential.

With the start of a new school year right around the corner, its time to start filling up the cart with back-to-school items. If the rows and rows of school supplies at Walmart and Target haven't already sucked you in, then Tax-Free Weekend is the perfect time to grab some of the key items that may be on your list.

Topics: Home, Life & School, Seasonal

With back-to-school time right around the corner, I was joined on the July Financial Friday Community Panel by Local Civic Leader Fred Nesta to talk about his partnered Back-To-School drive and Horry County School's Teacher of the Year, Emma Lyn Cain, to give parents and students advice for starting a new school year.

Topics: Home, Life & School

It's been three years to the week since I purchased my first home. With buying a house came the responsibility of so many things I had never had to think about while renting. I was now responsible for maintenance or repairs, lawn care, pest control, taxes, insurance, etc.

With any new purchases, there is typically some type of warranty, and for me, with new construction, I had a one-year window on many of the different systems within my home. My contractor and I became great friends over the year because I called him with a million questions and issues with anything warranty-related.

As I was nearing that one-year mark, I began to worry about what I would do and what it might cost to fix things after my year. Fortunately, I stayed alert and was able to avoid any extended warranty scams, where people tried taking advantage of that worried feeling. Check out the blog post below with some of the tips I used to avoid falling victim to warranty scams:

Topics: Real Estate & Home Buying, Home Loans, Identity Protection & Security

The time has come for you to do like Katy Perry said and "own the night like the Fourth of July," because this weekend, there will DEFINITELY be fireworks.

Topics: Personal Finance, Seasonal

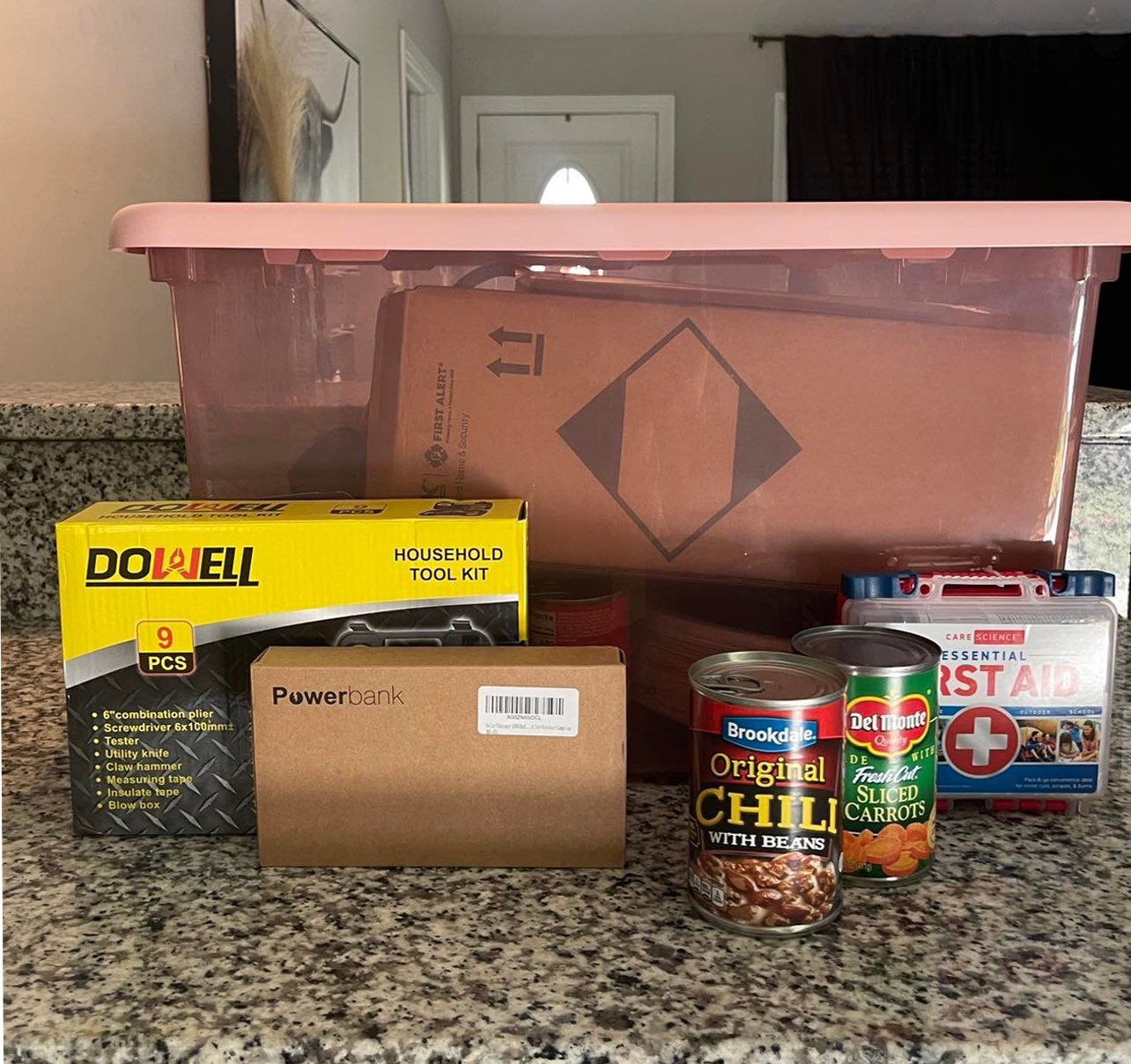

Living in an area that experiences hurricane season for six months out of the year, we need to be prepared. A great way to do a bit of pre-planning so that you're not panicking when a hurricane is on its way is to put together a Hurricane Preparedness Kit.

Topics: Home, Life & School, Seasonal

We're coming up on Memorial Day Weekend, which to most, is like the official kick-start to the summer. Schools are starting to get out for summer break, people from all over head to the beach for vacation, friends and family join together for cookouts, and everyone breaks out the fireworks and red, white, and blue. Although Memorial Day is a great time to gather with friends and family and celebrate the start of the summer, it's important that we all take time to remember the true meaning of the holiday and the individuals who sacrificed their lives for our freedom.

Below are some of the different Memorial Day events happening in our area that you can attend with loved ones and acknowledge those fallen soldiers:

Topics: Home, Life & School, Seasonal

If you didn't quite get your art fix at the recent Artfields festival in Lake City and want to discover more public art, you must check out the beautiful murals in Downtown Conway. All within walking distance from each other, or a quick peel scooter ride if you want to make it a bit more interesting, Historic Downtown Conway boasts nine gorgeous murals with unique backstories.

Topics: Home, Life & School