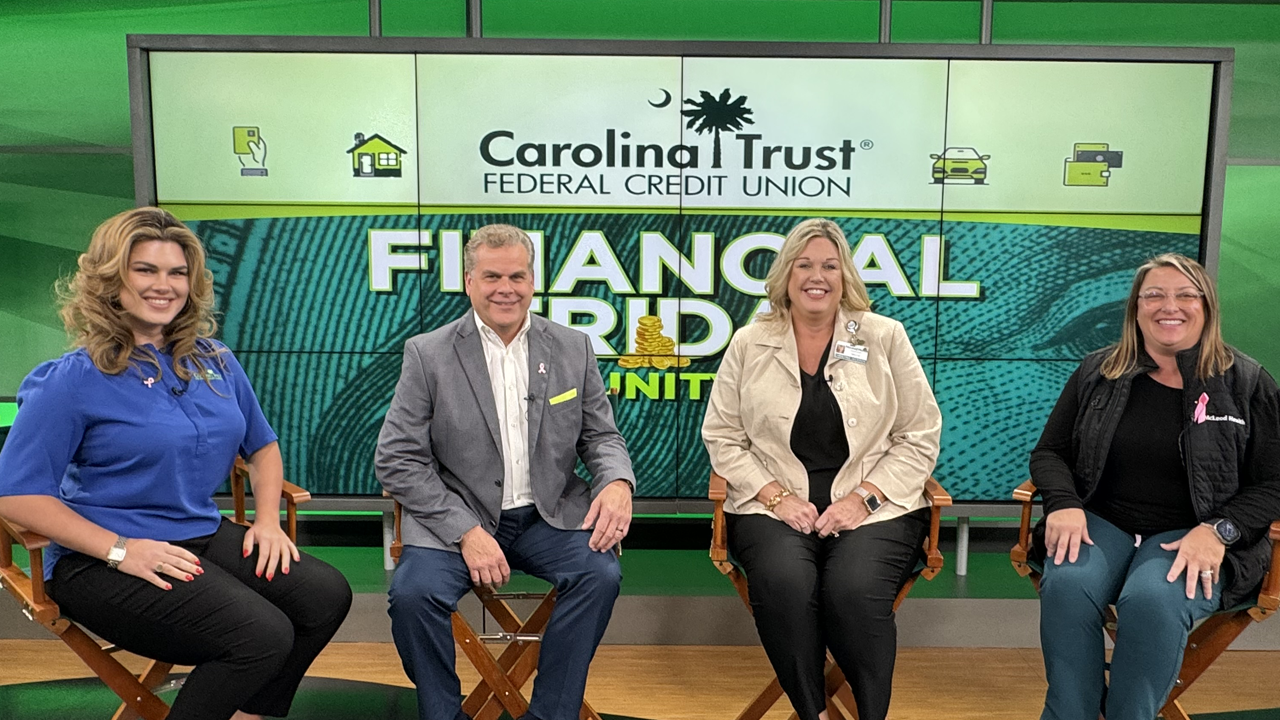

For the October Financial Friday Community Panel, I was honored to be joined by my President/CEO Tim Carlisle; Christina Jackson, Executive Director of the McLeod Health Foundation, and Nicole Spencer, Assistant Director of Oncology Services for McLeod Health, to talk about the McLeod Health Foundation, McLeod Health's upcoming Comprehensive Cancer Center and raise awareness for Breast Cancer.

Vlog: McLeod Health Breast Cancer Awareness Community Panel

It's officially pumpkin season! Pumpkins make the perfect fall decor, and who doesn't love carving/painting them for Halloween fun? However, with the South Carolina heat, you almost have to wait until later on in the season to run out and grab those pumpkins, or you'll end up with a rotten mess (yuck). But now that temperatures are starting to cool down and Halloween is right around the corner, it is full steam ahead for pumpkin patches.

Topics: Personal Finance, Seasonal

What You Need to Know About the New SAVE Plan for Student Loans

The Biden administration announced the Saving on a Valuable Education (SAVE) Plan in June 2023. The plan will put monthly payments at $0 for many borrowers and save others up to $1,000 monthly. Here’s how to know if you’re eligible and what to do if you are.

Topics: Personal Finance, Home, Life & School

October is here, which means it is officially spooky season. I love decorating and celebrating Halloween, but in doing so, I like everything to reflect my typical aesthetic, just in a holiday way.

Topics: Seasonal

On the August and September Financial Friday Community Panel segments, I was joined by two esteemed attorneys, Doug Lineberry and James K Gilliam, Equity Partners Burr Forman LLP for our “We ❤️ Our Lawyers” segments.

Prior to the "We ❤️ Our Lawyers" segments, we took submissions from members of the community with legal questions for our attorneys. Check out the segments below to see some of the questions that were submitted and our attorney's professional opinions:

Topics: Home, Life & School

In Part 1 of this series, we defined passive income as money received on a regular basis that only requires a little time or effort after the initial set-up. Now, we’ll look at specific examples of passive income to help you determine which might fit best with your situation and goals. Let’s get into it!

Topics: Personal Finance

Money Market Account: Here's What You Need to Know

Money market accounts were introduced during the 1970s as a type of mutual fund that brokerage houses sold. At the time, the federal government also capped how much interest local lending institutions could offer customers on the savings account, leaving them at a competitive disadvantage. A few Baby Boomers may recall how banks and credit unions offered incentives such as kitchen appliances and new gadgets to encourage people to open accounts.

But the Garn-St. Germain Depository Institutions Act in 1982 changed everything. The Act allowed local lenders to provide savings options with higher interest rates under the money market account umbrella. Now, working families can choose between a variety of money market products with competitive rates.

Topics: Investing & Retirement

CD vs Money Market: Steady Returns or Flexibility

Maintaining a diverse financial portfolio helps reduce investment risk and generate greater returns. Part of that balanced approach involves including assets that can be quickly leveraged. Basically, things such as money market accounts and certificates of deposit (CDs) are akin to having cash on hand. The major difference is they generate better interest rates than passbook savings accounts.

If you are considering adding a money market or CD as part of your portfolio strategy, it’s essential to understand the choice is not necessarily either-or. Money markets and CDs are both valuable assets with slight differences. Those CD vs money market distinctions could be simplified by just saying one provides steady returns while the other offers flexibility. But a deeper understanding could help you better prepare to build an actionable portfolio that achieves your financial and quality of life goals.

Topics: Investing & Retirement

Is a Certificate of Deposit Right for You? Explore the Risks and Benefits

Commonly called a CD, a Certificate of Deposit is a savings-based investment that produces a higher return on investment than many others in its class. Considered a sound, reliable investment, CDs are generally part of a well-balanced portfolio. By understanding how they work, as well as their benefits and disadvantages, community members can make informed decisions about adding CDs to their mix of financial holdings.

Topics: Investing & Retirement

Every year when the kids head back to school, and the weather gets cooler, the south gets ready for their favorite season of the year, football season. Sports have become such an integral part of our society that I feel like our seasons of the year revolve around them; Football Season, Basketball Season, Baseball Season and Summer.

With sports playing such a huge role in people's lives, they tend to start their children in youth leagues as early as possible and fill their nights and weekends with sporting events from that time on. According to the National Council on Youth Sports, parents spend an average of $671 per year on youth sports, with 20%of parents spending over $1,000 or more per year—on each child!

The good news is parents have options when it comes to sports-related spending. Check out the BALANCE blog post below for tips on how to balance the family sports budget:

Topics: Personal Finance